Manufacturing Workforce Trends That Redefined the Year

2025 has proven to be a pivotal year of transformation and adaptation. Yet, new challenges have emerged in talent access, automation adoption, and cost control. With turnover rates plateauing, wages remaining elevated, and tariffs reshaping supply chains, manufacturers have leaned on staffing partners more than ever to maintain productivity and keep operations running efficiently.

2025 Industry Initiatives

- Upskilling and Workforce Partnerships: Manufacturers have increasingly collaborated with technical schools and workforce development programs to build pipelines for entry-level and semi-skilled talent. These programs emphasize hands-on training in robotics, data systems, and production technology, ensuring that workers can adapt as roles evolve.

- Prioritizing Employee Well-Being: A renewed emphasis on safety, health, and balance has defined the year. Many companies expanded mental health support, wellness programs, and flexible shift structures, recognizing that a stable, supported workforce drives higher productivity and retention.

- Sustainability and Resilience: Manufacturers are investing in green production and responsible sourcing. This shift not only aligns with environmental goals but also creates new employment categories for workers focused on waste reduction, recycling, and compliance.

We Saw the Greatest Changes in:

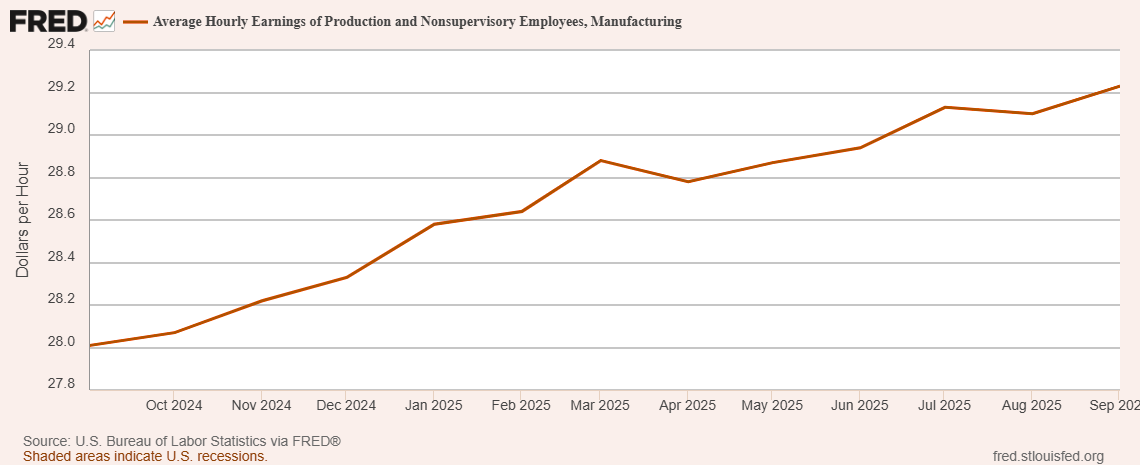

Wages

Competition for talent remained fierce throughout 2025, driving steady wage growth across the manufacturing sector. Average hourly earnings climbed from $27.89 in late 2024 to $29.03 by the fall of 2025 with many employers introducing retention bonuses or shift differentials to stay competitive.

Turnover

Turnover continues to challenge the industry – though it has begun to level out. The average manufacturing turnover rate in 2025 hovered around 30%, down slightly from 32% in 2024, according to Bureau of Labor Statistics. This may be due to the emerging trend called job hugging, also known as internal mobility. Employees in 2025 have increasingly valued stability, internal growth, and flexibility over frequent job changes.

To put that into perspective:

- 2017: 30%

- 2020: 44%

- 2023: 37%

- 2024: 32%

- 2025: 30% (Estimated)

Note: These percentages are calculated by summing the monthly total separations rates (BLS JOLTS). This is a common industry benchmark and is widely cited in HR and manufacturing reports. It means that, over the course of a year, about 30% of manufacturing employees separated from their jobs (including quits, layoffs, and other separations).

Voluntary turnover remains driven by:

- Competitive offers from nearby employers often for marginal wage increases.

- Workplace factors like lack of supervisor support, limited advancement opportunities, or poor onboarding experiences.

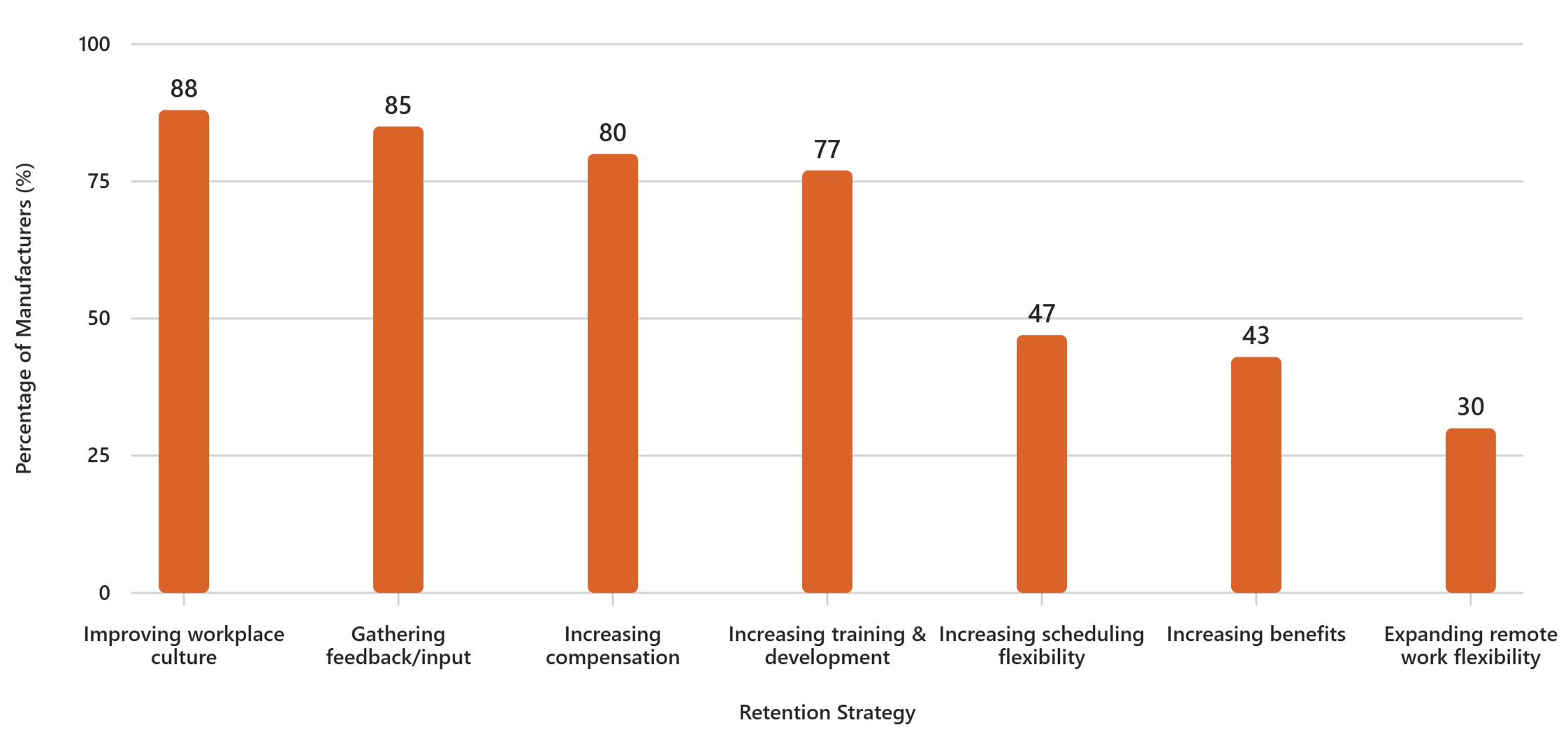

In 2025, we saw workplaces utilize strategies to increase retention such as:

In response, many employers are investing in career development paths, structured onboarding, and enhanced housing and transportation support – strategies that not only improve retention but also strengthen long-term workforce stability.

Cost Per Hire

Recruiting costs continued to rise in 2025 as businesses balanced inflation pressures, higher wage expectations, and longer hiring timelines. Staffing agencies focused heavily on reducing turnover costs through stronger candidate matching and long-term placement models. Manufacturers have shifted from short-term hiring fixes to sustainable workforce partnerships, emphasizing reliability and retention over volume.

We Saw the Overall Economy Experience:

Tariffs and Global Trade Shifts

The reintroduction and expansion of tariffs in 2025 had ripple effects across key sectors such as steel, plastics, and electronics. Manufacturers have begun and increasing domestic production, intensifying the demand for a dependable workforce.

Inflation and Interest Rates

While inflation cooled compared to early 2024, borrowing costs remained elevated for much of 2025. This pushed many manufacturers to streamline operations and optimize labor costs, relying on staffing partners for flexibility and scalability.

Automation investments accelerated this year, particularly in material handling, quality inspection, and data tracking. However, the human workforce remains essential and the need for employees who can adapt alongside technology has never been greater.

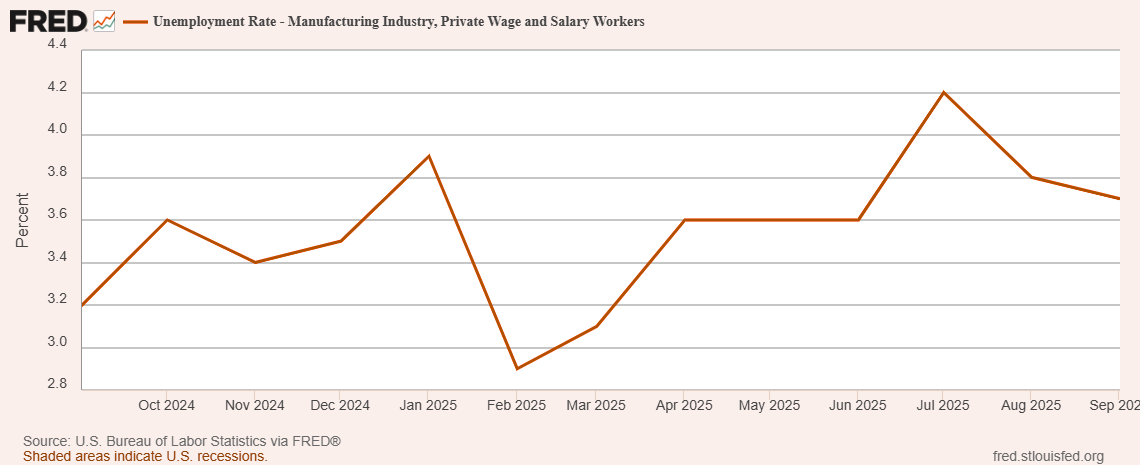

Despite slower overall economic growth, the manufacturing unemployment rate increased from 3.5% in August 2024 to last recorded 3.8% in August 2025, with more than 400,000 open positions nationwide. Staffing agencies continued to play a crucial role in filling these persistent gaps.

What We’re Expecting in 2026

- Employee Growth and Upskilling: The focus will shift even more toward tech-enabled and multi-skilled employees. Manufacturers are expected to expand apprenticeship programs and partner with technical schools to prepare workers for automation-heavy environments.

- Retention and Engagement: With the cost of turnover remaining high, employee experience will become a competitive differentiator. Employers will prioritize consistent communication, fair scheduling, and recognition programs that help employees feel supported and valued.

- Sustainability-Driven Roles: As environmental regulations tighten, the industry will see continued growth in sustainability-related staffing, including energy efficiency managers, compliance coordinators, and green operations specialists.

Where Do We Go From Here?

In 2025, the U.S. manufacturing workforce stands at roughly 13 million employees. Over the next decade, however, an estimated 1.9 million manufacturing jobs could remain unfilled due to retirements, declining labor participation, and the evolving demands of technology.

Bridging this gap will require a dual focus on technology training and the development of entry-level talent – ensuring that the human side of manufacturing continues to thrive alongside automation.

How Can KFI Staffing Help?

KFI Staffing is uniquely positioned to meet the needs of today’s manufacturing landscape. We deliver long-term, scalable staffing solutions that go beyond placement – including nationwide recruiting, housing, transportation, and on-site workforce support.

As manufacturers look to the future, our contingent workforce is ready to fill critical roles, reduce turnover, and keep production moving.

Let’s build a stronger, more efficient workforce for 2026.

Contact KFI Staffing today to discuss how we can help meet your workforce goals.