A Transformative Year for Staffing in Manufacturing

As the manufacturing industry evolves, 2024 proved to be a year of both challenges and opportunities. With turnover rates stabilizing after pandemic-era peaks and staffing costs climbing, manufacturers leaned heavily on staffing agencies to fill gaps and improve workforce retention. The adoption of technology and adjustments to inflation and interest rates reshaped how businesses approached hiring and workforce development.

We Saw the Greatest Changes in:

Wages

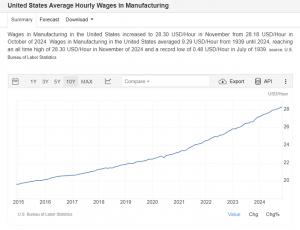

The competition for talent intensified, pushing wages higher across the industry. Manufacturing hourly wages saw steady increases, reflecting the need for competitive pay. Employers in the manufacturing industry saw their average hourly pay rate rise from $28.18 to $28.30 in October 2024 alone.

Turnover

Turnover in the manufacturing industry remained a challenge, averaging 38% in 2024. For comparison:

- 2017: 30%

- 2020: 44%

- 2023: 37%

For a manufacturer employing 300 entry-level workers in 2024, this means approximately 114 employees left over the course of the year- an average of nine per month.

Voluntary turnover is primarily driven by two main factors:

- Competition from Nearby Employers: Companies compete for the same talent pool, often losing workers for minor pay increases.

- Workplace Factors: Employees leave due to lack of support from supervisors, unmet job expectations, and limited opportunities for advancement.

Strategies like improving the employee experience, offering career development paths, and competitive pay can mitigate these losses.

Cost Per Hire

Inflation and economic pressures raised hiring costs. Staffing agencies focused on sourcing high-quality candidates who could grow within organizations, reducing turnover and long-term recruitment expenses. Businesses began prioritizing long-term solutions over quick fixes, reflecting a shift in hiring practices.

We Saw the Overall Economy Experience:

Election Year Dynamics

2024’s election season brought uncertainty, prompting businesses to delay expansions and hiring decisions in anticipation of potential policy changes.

Inflation and Interest Rates

Although interest rate cuts aimed to stimulate growth, inflation continued to challenge manufacturers. Rising raw material costs and tightened budgets forced companies to find efficiencies in their operations and workforce strategies.

Mass Layoffs

While some sectors experienced layoffs, manufacturing largely avoided the worst, though over-hiring in previous years led to workforce realignment in certain companies. With an overall unemployment rate of 3.7% and more than 600,000 job openings in manufacturing, staffing remained a critical focus.

What We’re Expecting in 2025:

Employee Growth

Upskilling will dominate workforce strategies. Companies are expected to shift their focus to technologically skilled roles as automation and Internet of Things (IoT) adoption accelerate. Traditional manufacturing roles may decline, creating opportunities for staffing agencies to support this transformation.

Unemployment Predictions

With unemployment expected to remain low, the labor market will remain competitive. Manufacturers will continue to prioritize retention, engagement, and training to combat labor shortages.

2025 Initiatives

- Upskilling: As emerging technologies like IoT and automation continue to evolve, apprenticeships and collaborations with technical schools will grow, creating pipelines for skilled talent to meet the demand for new expertise. These partnerships will offer hands-on training, equipping workers with the knowledge needed to operate advanced machinery and software. Manufacturers will also invest in continuous education programs to ensure employees can adapt to new systems and innovations.

- Prioritizing Employee Well-Being: Creating a safe and healthy work environment, offering mental health support, and fostering work-life balance through flexible schedules and paid time off. Additionally, providing training, wellness programs, employee engagement initiatives, and competitive compensation helps ensure physical, mental, and professional well-being, boosting job satisfaction and productivity.

- Leveraging Sustainability: As green supply chains become more prevalent, new staffing roles will emerge, such as sustainability officers, auditors, and environmental compliance specialists. These positions will require professionals skilled in sustainable practices, waste reduction, and energy efficiency. Manufacturers will also increasingly look for employees with expertise in sourcing eco-friendly materials, managing recycling programs, and ensuring that products meet environmental certifications.

Where Do We Go From Here?

In 2024, there were around 13 million manufacturing workers. Within the next 10 years, the number of unfilled manufacturing workers is expected to be around 1.9 million due to significant gaps in the labor workforce. This may be due to massive retirement, the steady decline in the prime-age workforce that makes up most manufacturing roles, declining birth rates, the prevalence of college degrees and the rise of AI. It will be important for employers to focus on technology training and reskilling the entry-level workforce to meet the human labor demands manufacturing operations will still require for decades to come.

How Can KFI Staffing Help?

KFI Staffing is positioned to meet the needs of the ever-changing manufacturing space because we offer a long-term solution for entry-level workers by recruiting nationwide and providing housing and transportation on a large scale.

Our team is ready to discuss how KFI Staffing can address your workforce challenges with a reliable, dedicated, and ready-to-work talent pool. Let us help you build a stronger, more efficient workforce in 2025. Contact us today to learn more!

Citations:

Job Openings and Labor Turnover – October 2024

Turnover Trends Showcase Manufacturing’s Talent Strategies | Manufacturers Alliance

Industries at a Glance: Manufacturing: NAICS 31‐33 : U.S. Bureau of Labor Statistics

United States Average Hourly Wages in Manufacturing